David Argente explains his research on how people adopt new payment technologies

EGC Affiliate Spotlight: David Argente

Ninety percent of transactions below 25 USD in Mexico in 2022 were made in cash, even though digital payment services are readily available and easy to use. This is an example of a trend across Latin America, Africa, and the Middle East: despite the advent of digital payment methods, often sponsored by governments, citizens of low- and middle-income countries (LMICs) struggle to adopt these new tools in place of cash.

Why is this the case, when these technologies – integrated into banks or housed on mobile networks – make the formal banking system more accessible for people in LMICs? Increasing adoption rates may have important societal benefits, like potentially reducing crime and connecting people to markets. What can get more people to use digital payments instead of cash?

Amra Kandic for EGC

Amra Kandic for EGC

Argente stands in front of the Yale School of Management in New Haven, CT.

Recent research by David Argente, an Assistant Professor of Economics at the Yale School of Management with a secondary appointment in the Department of Economics, and an EGC affiliate, sheds new light on these questions. In particular, his work emphasizes that potential users of digital payment services are often simply “waiting for their social networks to adopt” these technologies before doing so themselves – and with coauthors, he recently built an economic model around this forward-thinking decision-making behavior. The insights generated by this research can help policymakers maximize the effectiveness of public efforts to promote the transition away from cash.

A solutions-oriented mindset

Argente was inspired to study economics by his childhood in the municipality Tlalnepantla, close to Mexico City. During his early adolescent years, Mexico experienced financial crisis and economic volatility following the signing of the North American Free Trade Agreement (NAFTA). As Argente witnessed these economic effects on his friends and family, he felt compelled to understand how policymakers can better respond to macroeconomic shocks.

“As an economist, you want to understand the world but also come up with solutions to the problems that you see,” Argente said. “You're trying to find solutions that policymakers might implement and make a difference.”

Argente honed his analytical skills as an undergraduate at the University of Texas at Austin and while pursuing a masters in economics at the London School of Economics. In 2018, he obtained his PhD in economics from the University of Chicago, where his research focused on the relationship between macroeconomic shocks and product innovation.

Throughout his studies, Argente’s commitment to his home country remained strong. In 2022, he became interested in issues related to technology adoption. With so many new digital payment services becoming available, he wondered, why are Mexicans – like people in many LMICs – hesitant to switch away from cash?

With his colleague Fernando Alvarez, Argente studied the issue with a bold experiment: they convinced Uber to share deidentified data, enabling them to test how people preferred to paid for rides around Mexico City, one of the areas in Mexico where Uber allows for both cash and card payments. They designed and conducted three large-scale field experiments, which involved approximately 400,000 riders. These experiments allowed the researchers to analyze riders' payment preferences and estimate the loss in consumer surplus from a hypothetical ban on the use of cash. The results showed that, if no cash payments were allowed, Uber riders who used cash as means of payment either sometimes or exclusively would suffer an average loss of around 50 percent of their total cash-based trip expenditures. Consumer surplus losses fall mostly on the least-advantaged households, who rely more heavily on the cash payment option. These results inspired Argente to pursue a broader research agenda focused on exploring the underlying nature of the technology adoption of payment methods, which led him to Costa Rica.

Studying mobile money in Costa Rica

In May 2015, the Central Bank of Costa Rica launched the country’s Mobile National System of Electronic Payments – known colloquially as SINPE Móvil. By 2021, the service was being used by more than 60 percent of Costa Rican adults, and the value of SINPE Móvil transactions was equivalent to 10 percent of the country’s total gross domestic product (GDP). While primarily used at first by high-income, high-skilled adopters, it has gradually gained traction among most Costa Ricans.

The Costa Rican government expected SINPE Móvil adoption to gradually gain momentum over time, which aligns with the existing literature on technology adoption. But this literature is usually informed by experimental settings that are not dynamic: they do not capture how people’s decisions and expectations adapt over time, and thus do not encompass the full extent of available decision-making possibilities.

Amra Kandic for EGC

Amra Kandic for EGC

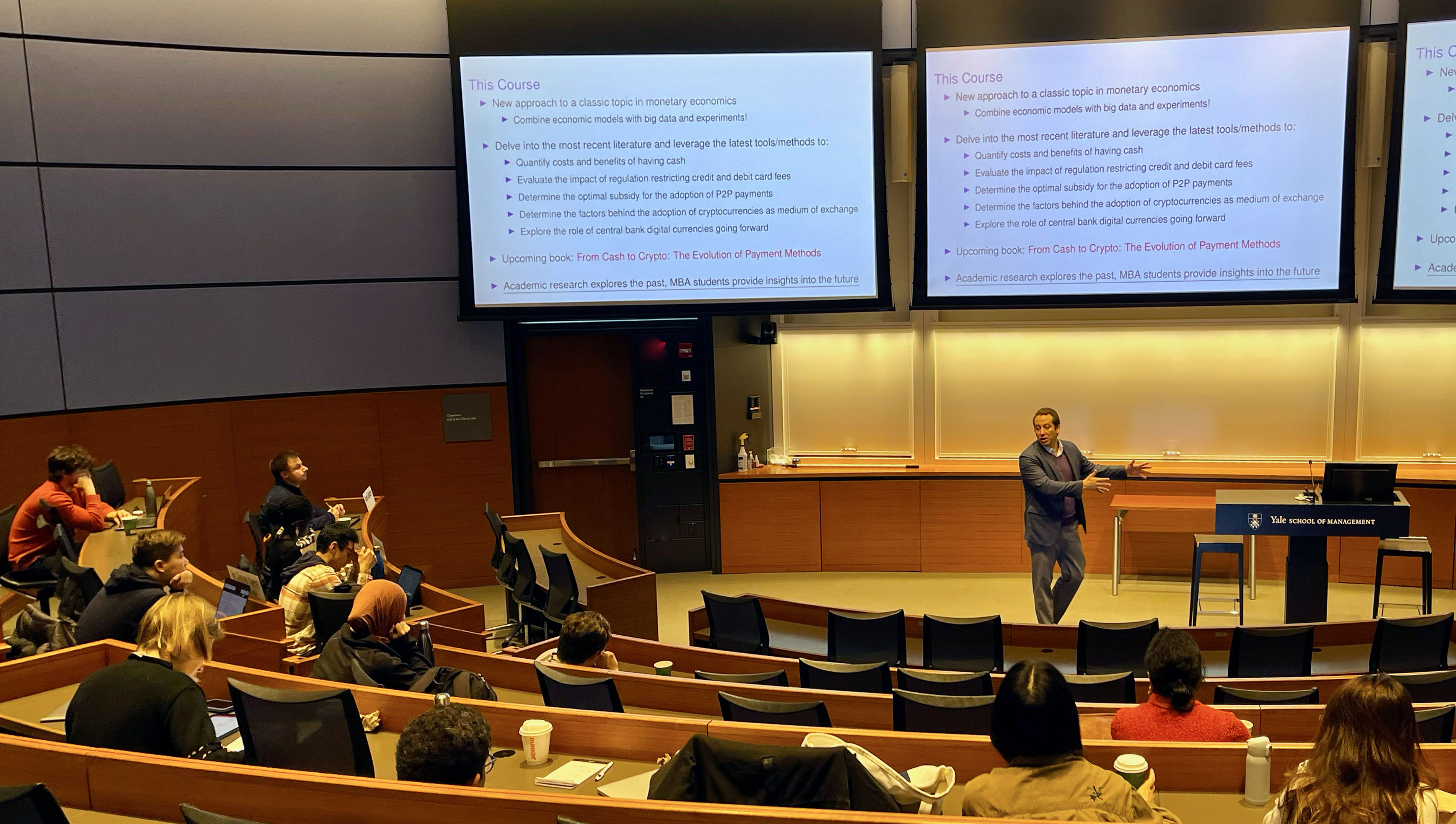

Argente teaching a course at the Yale School of Management.

Argente believed that a forward-looking model for decision-making – based on individual expectations for future adoption and not just present realities – could offer more nuanced insights. Such a model could consider not just how people respond to the current uptake of a technology, but also whether they can reasonably expect many people to use it in the future. Analyzing SINPE Móvil’s successful adoption offered an ideal opportunity to test these hypotheses.

Are cryptocurrencies currencies? Bitcoin as legal tender in El Salvador

In an effort to boost financial inclusion, El Salvador made Bitcoin an official currency and offered incentives for adopting it. Research by EGC Affiliates David Argente and Diana Van Patten of the Yale School of Management and a coauthor found that a lack of trust caused use of the cryptocurrency to fall off quickly. The study provides lessons to countries aiming to adopt digital currencies.

Designing a forward-looking model of technology adoption

Argente partnered with Diana Van Patten, an Assistant Professor of Economics at Yale University’s School of Management, EGC affiliate, and Costa Rican native; Esteban Méndez, a researcher at the Central Bank of Costa Rica; Fernando Alvarez from the University of Chicago; and Francesco Lippi from LUISS University. The researchers gained access to SINPE Móvil data – all anonymized to maintain users’ privacy – enabling quantitative analysis on the technology’s usage patterns.

The resulting paper outlines a novel, forward-looking model for what drives people’s decisions about adopting a new technology. Unlike traditional models, Argente and his coauthors’ model considers how perceptions of future adoption trends influence people’s decisions – what the researchers call the “waiting to adopt” mechanism.

“Agents make what we call inter-temporal decisions,” Argente said. “They are not myopic – they consider what they think is going to happen in the future. Their decision to adopt depends on whether their social network adopted has or will adopt.”

The model developed by Argente and his coauthors can inform governments about the optimal time to subsidize digital payment services. The researchers chart an array of adoption scenarios based on a range of subsidy strategies, allowing for more accurate projections around the pace and scale of adoption. They find that even small subsidies can amplify adoption rates, and their “waiting to adopt” mechanism provides policymakers with tools for choosing the ideal time to introduce subsidies that will encourage low-income individuals to transition.

Looking ahead

Argente and his coauthors are now working to calibrate their model using new datasets from digital payment programs in other LMICs. With dozens of central banks considering digital payment platforms around the world, their research deepens our understanding of the adoption curves for such technologies. Beyond digital payments, such models can be applied to better understand user uptake for a range of welfare-enhancing efforts – including digital tools, web-based activities, or even government-sponsored social protection programs.

In his future work, Argente plans to continue exploring how people decide to use new products and technologies, and how these insights can be harnessed for the public good. How should policymakers think about new forms of money like cryptocurrency, for example, and what are their effects on welfare? While passionate about the study of macroeconomics, development, and monetary policy, Argente always looks through a solutions-oriented lens.

“Our lives are quickly changing as new products and technologies are introduced, and understanding their adoption process is key to understand the world,” Argente said. “We as economists have a great opportunity to help design policies that increase social wellbeing and make a difference.”

Written by Atl Castro Asmussen