News Item

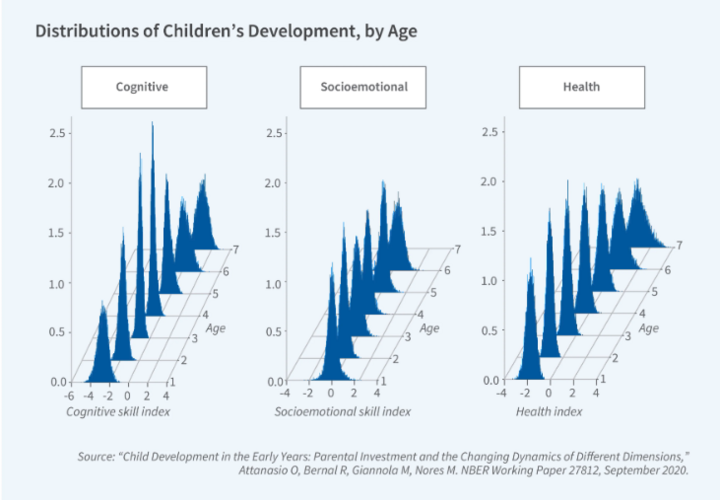

… Orazio Attanasio and Elisa Cavatorta introduce their brief on … measurement innovations … November 8, 2022 | News Orazio Attanasio and Elisa Cavatorta introduce their brief on … Methods Brief & Working Paper CEDIL homepage … Orazio Attanasio and Elisa Cavatorta introduce their brief on …

Relevance: 41.41957