Towards Gender Equality Newsletter Issue #7: Women in Leadership

International Women’s Day is this Saturday, a day to reflect on the history, present, and future of gender inequality. I’m using this occasion to reflect on the prospect of leadership in a turbulent world and a future fraught with grave uncertainty, and also if more women in leadership positions may matter for gender equality outcomes.

One may look at the experiences of countries throughout history with a few women leaders in the midst of a sea of men in authority and conclude that female leadership is of limited relevance.

However, as the papers featured below illustrate through careful empirical investigation in many country contexts, there is rising evidence that greater representation of women in leadership positions impacts gender gaps and typically lowers them. In recent decades, gender quotas have increased female leadership in politics but possibly also engendered backlash from those who favor the status quo. Understanding the resulting shifts in political economy dynamics will be critical to enabling a more equal future.

Aishwarya Lakshmi Ratan

EGC Deputy Director

Research Highlight

Can Female Directors Shrink the Gender Gap? Evidence from France

Ladant & Paul-Delvaux [Working Paper]

Women are under-represented in corporate leadership. In 2023, they accounted for only 16% of CFOs and 7% of CEOs in large U.S. and European companies. Over the past two decades, investors, business leaders, and policymakers have advocated for measures to increase female board representation, which has subsequently increased in U.S. and European corporations from 15% in 2010 to 30% in 2023.

Ladant and Paul-Delvaux investigate whether increasing female representation on corporate boards translates into broader gender equality within firms. They focus on France’s 2010 board quota, which required listed and large non-listed firms to have at least 40% female board members by 2017, and examine two questions: Does adding more women to corporate boards improve gender representation and reduce gender wage gaps? Can these improvements be achieved without hurting firms' economic performance?

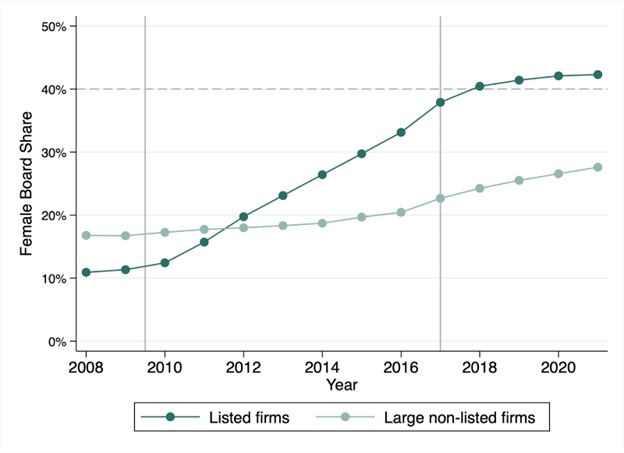

To identify causal effects, the paper exploits ex-ante differences in compliance incentives between listed and non-listed firms. While both were subject to the same quota, only listed firms had to publicly disclose their board composition in annual reports. This accountability gap led to a substantial difference in quota implementation between otherwise similar firms (Figure 1). This variation is used to estimate the quota’s impact.

Through the insights that follow, Ladant and Paul-Delvaux provide the first robust evidence that board gender quotas can significantly reduce, though not eliminate, gender disparities throughout firm hierarchies.

Figure 1. Percentage of Female-Owned Firms Across Regions

Note: Listed firms quadrupled their female board share from 11.3% in 2009 to 42.3% in 2021, while large non-listed firms showed a more modest increase from 16.7% to 27.6%.

Insight 1: Female directors increase female representation at the top of the corporate ladder

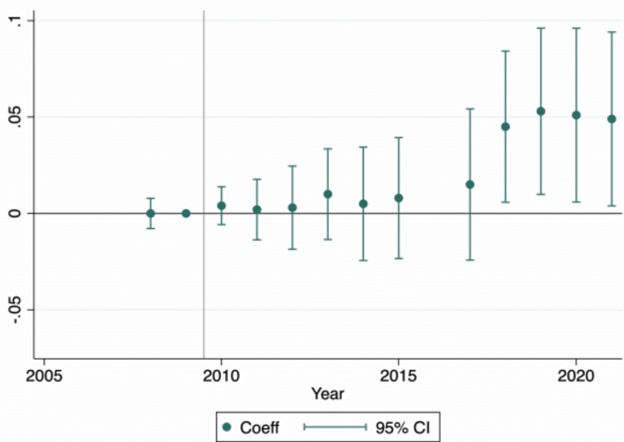

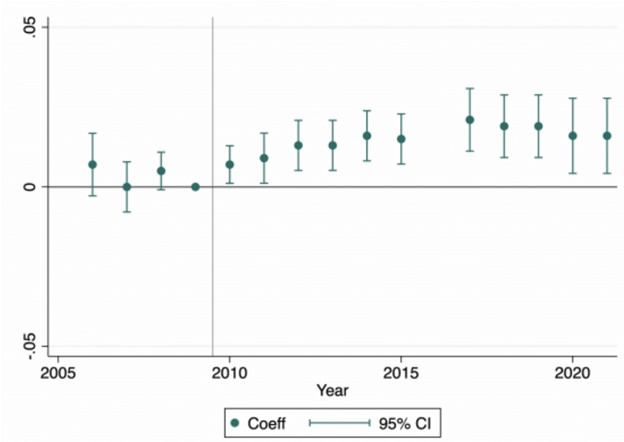

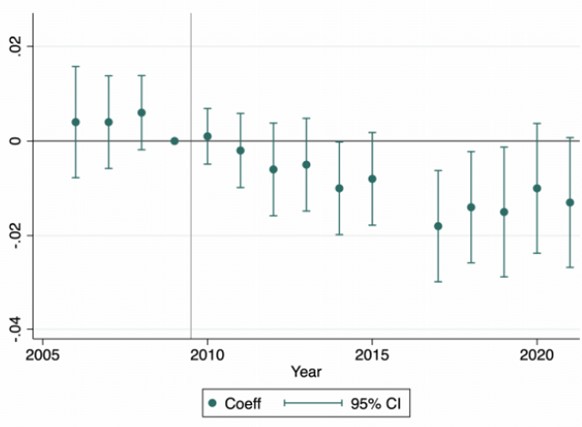

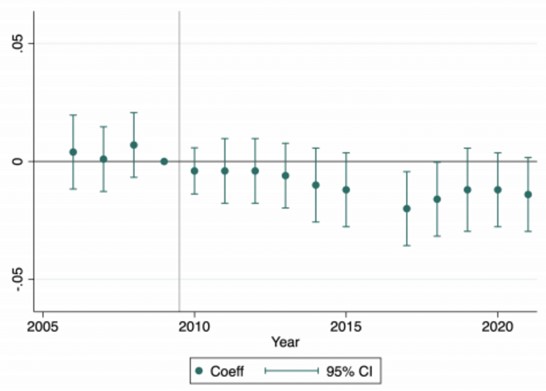

A higher female board share generates positive spillovers for other senior women. Figures 2 and 3, based on Difference-in-Differences estimators, show significant increases in female CEO appointments and women's representation among top earners. Instrumental variables estimates show that the quota doubles the likelihood of having a female CEO, and increases the share of women in the highest parts of the earnings distribution but not lower. This result is consistent with the central role of boards in appointing the CEO and other top executives.

Figure 2: Impact of the Quota on the Likelihood of Having a Female CEO

Note: This graph plots the DiD estimates where large non-listed firms are the control group and listed firms are the treatment group. The vertical grey line shows the year at which the quota was implemented. See paper for more details.

Figure 3: Impact of the Quota on Female Share Among Top 10% Earners

Note: This graph plots the DiD estimates where large non-listed firms are the control group and listed firms are the treatment group. The vertical grey line shows the year at which the quota was implemented. See paper for more details.

Insight 2: A larger female board share reduces gender pay gaps throughout the wage distribution

Boards with greater female representation help reduce gender wage gaps across the entire wage distribution (Figures 4 and 5, which show Difference-in-Differences estimates). Instrumental variable estimates indicate that a 30 percentage point increase in the female board share leads to a 2.1 percentage point decline in the average gender wage gap by 2021 — a 12% reduction compared to 2009. This narrowing of the gap is not confined to top earners but is observed throughout the wage distribution, a result that appears to be driven primarily by adjustments in the wages of incumbent employees, rather than newly hired workers.

Figure 4: Impact of the Quota on the Mean Gender Wage Gap

Note: This graph plots the DiD estimates where large non-listed firms are the control group and listed firms are the treatment group. The vertical grey line shows the year at which the quota was implemented. The mean gender wage gap corresponds to the unadjusted gender wage gap (without controlling for any worker characteristics). See paper for more details and additional results on the adjusted gender wage gap.

Figure 5: Impact of the Quota on the Bottom Quartile Gender Wage Gap

Note: This graph plots the DiD estimates where large non-listed firms are the control group and listed firms are the treatment group. The vertical grey line shows the year at which the quota was implemented.

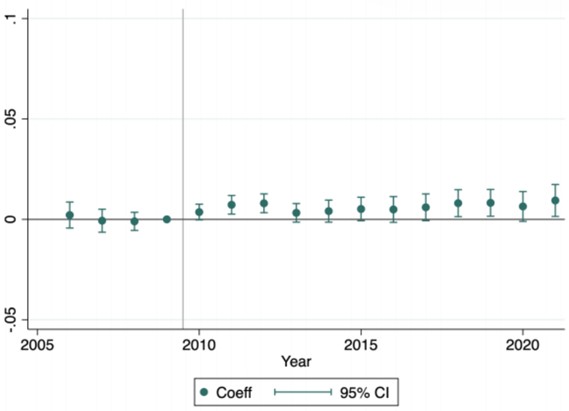

Insight 3: Gender equality improvements do not harm firm performance

Ladant and Paul-Delvaux then address the concern that greater gender equity may affect firms’ financial performance. They show that the reduction in gender wage gaps occurs through an increase in wage growth for women rather than slower growth for men. While this increases labor costs— with the share of the wage bill allocated to women rising by approximately 4% between 2009 and 2021—there is no evidence of a decline in profitability, as measured by the ratio of operating income to net assets. Their results suggest that this may be partly explained by increased productivity.

Figure 6: Impact of the Quota on Profitability (Operating Income to Net Assets Ratio)

Note: This graph plots the DiD estimates where large non-listed firms are the control group and listed firms are the treatment group. The vertical grey line shows the year at which the quota was implemented.

Insight 4: Newly appointed female directors drive change by tying CEO compensation to gender equality goals

Ladant and Paul-Delvaux find that boards with more women use their compensation-setting power to incentivize CEOs to address gender disparities, as they are more likely to use gender-equality-based performance metrics when setting wages and adopting such incentives show larger improvements in gender equality. Moreover, the gender gap in directors’ past top executive experience shrinks by half following the quota, driven by a 33% increase in executive experience among female directors. Post-quota female directors are also more likely to hold seats on key board committees. Taken together, this evidence shows that women are not relegated to symbolic roles in the boardroom.

Featured Researcher: Louise Paul-Delvaux

Louise Paul-Delvaux is a Research Economist at the World Bank, studying labor markets in low-income settings and policies that can reduce gender disparities in employment and income. She holds a PhD in Economics from Harvard University.

In a working paper titled “Minimum Wage, Informality, and Gender Gaps: Evidence from Morocco,” Paul-Delvaux investigates how minimum wage policies affect gender gaps in employment and wages in Morocco, a setting characterized by a large informal sector and wide initial gender disparities. Her recent contribution with Francois-Xavier Ladant, “Can Female Directors Shrink the Gender Gap? Evidence from France,” which we feature above, exploits a 2010 gender quota as an exogenous shock to board composition, to study the impact of female directors on labor outcomes for women and firm financial performance. Among other work, Paul-Delvaux is currently researching the role of managers in parental leave take-up, the gendered impacts of group-based formal lending in rural India and the effects of legal rights awareness programs for widows in Egypt.

See Paul-Delvaux’s website for more information.

“When systemic barriers limit opportunities for women and minorities, we are not just perpetuating inequity — we are creating a misallocation of talent that undermines economic potential. My research shows that well-designed policies can help correct these inefficiencies, allowing firms to tap into a broader pool of talent without sacrificing performance.” - Louise Paul-Delvaux

New Research

Do Female–Owned Employment Agencies Mitigate Discrimination and Expand Opportunity for Women?

Hunt & Moehling [Working Paper]

The authors create a dataset of 14,000 hand-coded help–wanted advertisements placed by employment agencies in three U.S. newspapers in 1950 and 1960, a time when help–wanted advertisements were divided into male and female sections, and collect information on agency ownership. The authors find that female-owned agencies specialized in vacancies for women, thereby expanding the access of female jobseekers to agency services, including for positions in majority-male occupations. Female-owned agencies advertised more skilled occupations to women than did male-owned agencies, leading to a 5.5% higher wage for women. On the other hand, female-owned agencies had a greater propensity to match male jobseekers to clerical jobs, contributing to 21% lower male wages than for male-owned agencies. The results are consistent with female proprietors having had a comparative advantage in female jobseekers and clerical occupations or with client firms having trusted female proprietors only with vacancies for women and homogeneous, lower-skill occupations. However, in choosing to establish an agency and to specialize in female jobseekers, female proprietors may have sought to mitigate employer discrimination against female jobseekers; their higher propensity to advertise majority-male occupations among professional, technical and managerial advertisements for women may also reflect discrimination mitigation.

Gender and Electoral Incentives: Evidence from Crisis Response

Chauvin & Tricaud [Working Paper]

This paper provides new evidence on why men and women leaders make different choices. The authors first use a simple political agency model to illustrate how voters’ gender bias can lead reelection-seeking female politicians to undertake different policies. The authors then test the model’s predictions by exploring leaders’ responses to COVID-19. Assuming that voters expect policies to be less effective if decided by women, the model predicts that female politicians undertake less containment effort than male politicians when voters perceive the threat as low, while the opposite is true when voters perceive it as serious. Exploiting Brazilian close elections, the authors find that early in the pandemic, female mayors were less likely to close non-essential businesses and female-led municipalities experienced more deaths per capita, while the reverse was true later on, once the health consequences materialized. These results are exclusively driven by mayors facing reelection and stronger in municipalities with greater gender discrimination.

Gender Quota Laws and Women in Cabinets

Barnes, Venturini, Weeks [Working Paper]

Do legislative gender quotas increase women's presence in executive cabinets? Women are underrepresented in politics, especially in leadership roles. As a remedy, quotas, requiring women to be nominated as candidates or elected in reserved seats, have been adopted for national parliaments in over 80 countries. But, can quotas work beyond the positions to which they apply? The authors argue that legislative quotas increase women in the executive by augmenting the supply of women ministers. Using a difference in-differences approach, the authors analyze the impact of quotas on the gender composition of cabinets worldwide (1990-2021). They find that quotas increase women in cabinets by 2.2 percentage points. Consistent with their supply-side argument, effects are concentrated in parliamentary democracies, countries sustaining a high 'shock' to women in parliament post-quota implementation, and low-prestige portfolios. The authors’ findings suggest quotas for parliaments have important spillover effects in governments, while leaving male dominance in the most powerful roles largely intact.

Female Politicians and Corruption in Rural India

Hastawala, Chatterjee, Taveras Pena [Working Paper]

This paper exploits random assignment of female quotas for leadership positions on Indian village councils to assess its causal effect on corruption. Since the mid-1990s, India has mandated that one third of village council chief positions be randomly reserved for women. Using data from the Rural Economic and Demographic Survey (REDS) 2006, the authors find that an additional term reserved for a female head as opposed to just a single one reduces both the occurrence and amount of bribes paid to the local government by households. This reduction is also observed in bribes paid to other local officials suggesting downstream effects of electing female officials on corruption. As a potential mechanism, the paper provides speculative evidence that it takes time for women political leaders to establish and settle, and when they are able to do so, they appear more efficient and transparent, especially in terms of selecting households as beneficiaries for government programs.

Gender Minority: A Non-Pecuniary Approach to Political Capital

Cai, Li, Liu [Working Paper]

Social minorities benefit from in-group favoritism, and companies may leverage this as a non-pecuniary strategy to access political capital. The authors examine the gendered implications of corporate responses to city-level political turnovers in China, specifically when the leadership shifts from male to female politicians. They show that politician turnover induces firms headquartered in a city to increase the presence of women on the board of directors, particularly in the position of chairman or CEO. This result is unlikely to be driven by gender equality concerns or other firm characteristics. Firms selecting a female director witness significantly increased abnormal perquisites and financial support from the government. This paper suggests that gender minority can be a subtle way of accessing political capital, and boosting female representation can help curb the in-group favoritism.

Female Leadership in India: Firm Performance and Culture

Sahay, Srivastava, Vasishth [NCAER Working Paper]

This paper documents the status of gender-inclusive corporate leadership in India and uses the woman director mandate in The Companies Act (2013) to study its relationship with firm outcomes, including financial performance and corporate culture in India. The authors combine personnel-level data from NSE-listed firms with firm performance data and employ a reverse difference-in-difference econometric strategy, to find that having at least one woman on board is associated with higher economic performance, financial stability, and lower financial risk. Additionally, using almost 400,000 employee reviews scraped from a company review platform, they find that higher shares of women in board positions correlate positively with employee ratings and sentiment scores only when firms also hire women in top management positions. This analysis highlights the business case of appointing more women at the top.

Policy Engagement, Events & Media Coverage

EGC at the World Bank-IMF Spring Meetings

EGC is collaborating with partners based in Washington D.C. to host discussions focused on structural transformation, jobs, growth, and women's economic empowerment during the World Bank-IMF Spring meetings, on April 24th and 25th, 2025. One event will present new research on gender, labor markets, and structural transformation in India, Mexico, Morocco and from across studies in Sub-Saharan Africa. We invite colleagues who will be at the Spring meetings in D.C. to join us. More information is available at this webpage, which will be updated as additional details are confirmed.

North East Universities Gender Day on April 3

[Event Summary; Register Here]

Yale EGC is hosting a full-day conference on April 3 to bring together early-career and senior scholars in the northeastern United States to explore the role of gender in the economy. The event will feature presentations by early-career economists (PhD students and postdocs), including on early-stage projects, as well as opportunities to get feedback from more senior researchers.

Insights for Enhancing Women's Political Participation in Nepal’s Local Elections

As part of the Nepal National Governance Symposium, Inclusion Economics Nepal led a 2-hour plenary session on December 20, 2024 that brought together a group of distinguished female leaders and thinkers to discuss barriers to women’s political representation in Nepal.

Read Our 2024 Annual Report

EGC Annual Report 2024: A Focus on Institutions

[Report]

This year’s EGC Annual Report: A Focus on Institutions highlights how our researchers, frequently working together through EGC initiatives, are examining ways to strengthen institutions. This comes at a time when institutions across the world are being tested – with many failing. The 2024 Annual Report also covers EGC’s reach and impact, introduces new members of the EGC community, and describes the research our faculty affiliates published during the 2023-24 Academic Year across a broad range of topics.