Looking back on the 2022 Kuznets Mini-conference, “Political Distortions and Economic Development”

The Economic Growth Center hosted the Kuznets Mini-Conference on Political Distortions and Economic Development on April 1, 2022. Nathan Canen and Julio Solís describe the event co-organized by Professor Leonard Wantchekon and Nathan Canen, featuring new studies on political economy by young researchers.

by Nathan Canen and Julio Solís

Political distortions, economic development, and policy experimentation: an agenda for political economy

Governments create opportunities for economic growth and development.

However, governments can also intervene in markets in ways that are detrimental for growth. For instance, they can offer advantages to certain firms in procurement or through preferential regulation instead of promoting competition. Politicians can allocate public investments inefficiently (by targeting regions or groups based on political considerations, for example) or apply discretionary contract enforcement to favor some stakeholders over others. We call such actions political distortions, as growth and development outcomes would be suboptimal due to political incentives and choices.

When and how do such political distortions arise? What types of policies can lead to improved government investment and public good provision in the presence of political incentives? What are their effects on market structure, concentration, and prices? What kinds of welfare and distributional impacts do political distortions have? And how can we design effective policies to minimize their negative impacts?

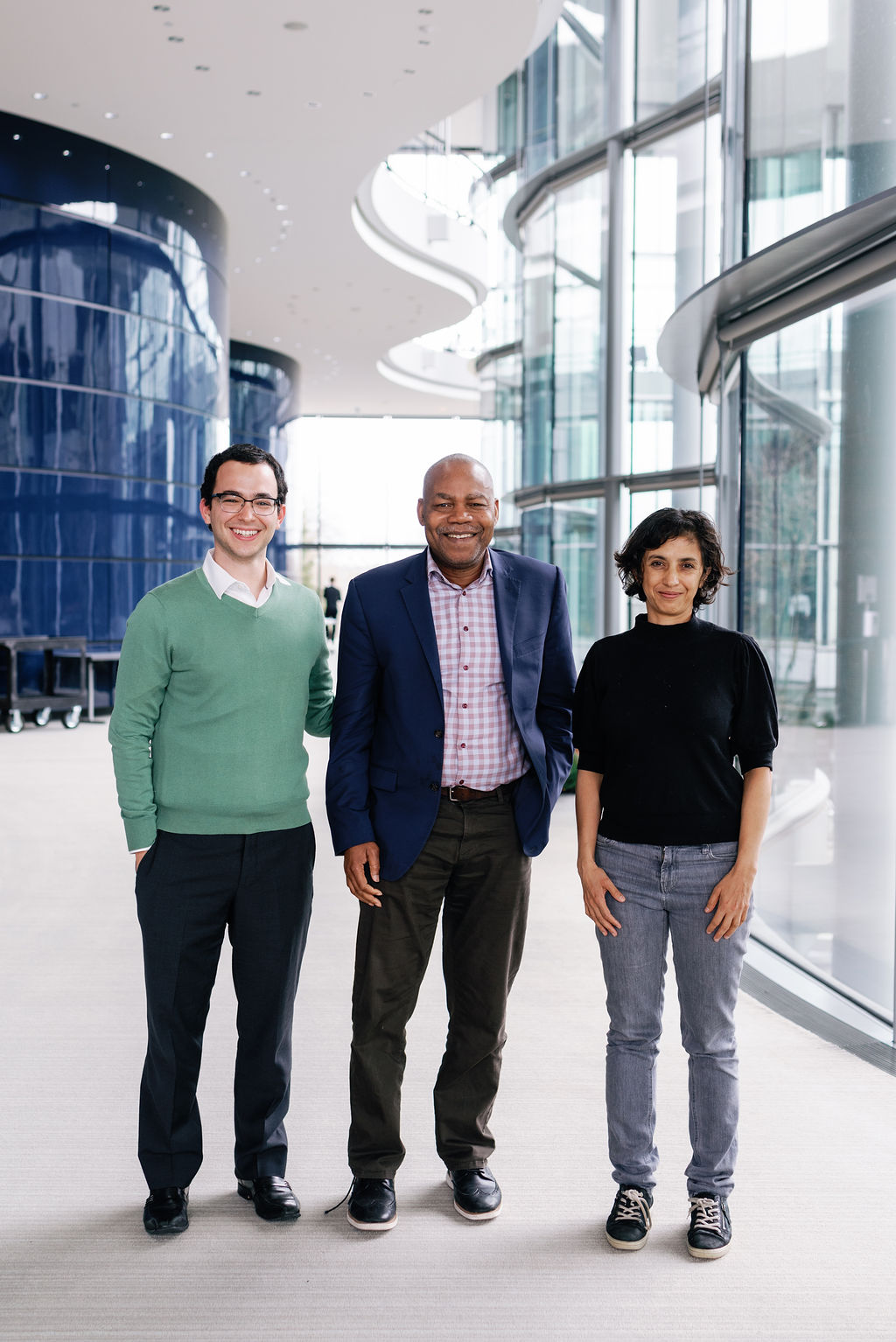

A lunchtime panel on research and directions in political economy featured (left-to-right) Gerard Padró i Miquel (Yale University), Leonard Wantchekon (Princeton University), and Rohini Pande (Yale University). Photo by Julia Luckett.

The Yale Economic Growth Center Mini-Conference on “Political Distortions and Economic Development”

The Yale Economic Growth Center organized a one-day mini conference on April 1, 2022 to discuss progress on these questions. The event followed Professor Leonard Wantchekon’s lecture “Political Distortions and Economic Development”, the 31st Simon Kuznets Memorial Lecture, which discussed and stimulated research on the topic.

The one-day mini conference consisted of three parts:

- Theoretical contributions: What are the economic outcomes we desire, and how do political incentives affect them?

- Empirical works: Quantifying the extent of political distortions in different markets and regions, and

- Institutional experimentation: What types of policies and/or political institutions can improve on current economic development and bring us closer to the “efficient” benchmarks?

The Role of Political Incentives on Firm Productivity, Markets and Economic Growth

A common theme in the conference was that while firms may grow because of investments in technological innovation or growing productivity, they may also benefit from political connections and protection that would insulate them from competition. Both margins may benefit firms, but political connections may be more harmful for consumers and imply that different regulatory policies are necessary.

The conference was a great place to discover theoretical and empirical literature about political distortions. My main take-away was the impact political distortions can have on market structure and discouraging innovation, which made me wonder how much political distortions undermine development.

– Yabo Gwladys Vidogbena

PhD Student at University of Houston, Department of Economics and former student at the African School of Economics

Dana Foarta presented a model where firms could increase their profits by undertaking costly technological innovations and/or by political protection. However, a firm with better technology than its competitors does not need as much government protection for the same profit. In this case, the government may “manage competition” by designing policies that discourage technological innovation by the leading firm. The latter then needs the government more. This leads to a “negative loop” between market and political incentives: the government discourages innovation, the leading firm invests less in new technology, leading to a stagnated technology, at the detriment of consumer welfare.

The 31th Kuznets Memorial Lecture: Political Distortions and Economic Development

In a lecture on March 31, 2022, Professor Leonard Wantchekon discussed recent research on the role of political institutions in economic growth and development, focusing on frictions induced by the political process and providing an overview of institutional reforms that may curb such distortions.

The effect of political incentives on market organization and structure was also explored by Salomé Baslandze and co-authors. Using extensive Italian micro-data and a theoretical model, they show that market leaders are more often connected with politicians and innovate less. This is because political connections induce productive firms to stay out markets dominated by a politically connected incumbent, who may benefit from favorable regulation. This, again, is costly for the aggregate economy.

Such political distortions can go beyond individual markets. Marina Azzimonti presented a theoretical model where fiscal policy is shaped by political constraints (representatives care about local issues, which may be different than those of national interest). When rules for fiscal policy are more flexible, due to weaker checks and balances, countries borrow too much, spend on narrowly targeted transfers and default more often than those with tighter political constraints. The model applied to Argentina in the early 2000’s suggests that these mechanisms are empirically relevant.

Conference presenters and attendees met for lunch at the 2022 Kuznets Mini-conference. Photo credit: Julia Luckett

The Incentives that Sustain Political Distortions

A second salient theme in the conference investigated the political logics that sustain these distortions. These works highlight how firms choose how to influence policy strategically.

Through the different presentations, the conference has enhanced my knowledge on the link between political distortions and market competition as well as how state capture is affected by political uncertainty. I really enjoyed the variety of topics discussed in the presentations and the panel discussion.

– Christelle Zozoungbo

PhD Student at Pennsylvania State University, Department of Economics and former student at the African School of Economics

Gleason Judd presented a game-theoretic model of how firms gain access to politicians, possibly with the goal of ultimately influencing policymaking. A key innovation is the presence of dynamic incentives: the simple possibility that a firm may obtain access to politicians in the future shapes economic policies in the present. Hence, the possibility that firms may obtain access can already shape policy, by itself, without the need for further lobbying.

While only access may gain influence, sometimes firms opt for more blatant strategies to shape policymaking. Nathan Canen and co-authors studied how firms react to political uncertainty by changing the ways in which they interact with politicians. When facing higher uncertainty about who will remain in power, firms prefer to control the bureaucrats in charge of implementing policy (which they term direct capture), rather than influencing elected politicians who control bureaucrats. Working with bureaucrats guarantees firms a higher likelihood that desired policies may be implemented (meaning, entry barriers to competing firms may be imposed), even if their political connection is not elected.

EGC to host North East Universities Development Consortium (NEUDC) 2022 Conference

#NEUDC2022 will be held in-person in New Haven, CT. The program will begin with a welcome reception Friday evening, November 4, 2022 and sessions will run all day Saturday, November 5, and Sunday morning, November 6.

Sabrin Beg also explored how electoral uncertainty shapes political distortions. In Pakistan, land-owning elites build patron-client relations with their rural tenants through transfers that function as risk-mitigating mechanisms. In this context, elections increase clientelism and technological change may reduce the power from elites by decreasing the former’s dependence.

Institutional Experimentation and Policy Implications: How to Improve Welfare and Avenues for Future Research

These papers highlight the complex strategic interactions between firms, citizens and politicians, spanning different forms of interaction, policies and regions (both developing and more developed economies). Knowledge of such incentives can be used to design effective policies.

Cesi Cruz presented work with co-authors on how information can counteract politicians’ clientelist strategies. To study this topic, the researchers design a careful experiment that compares different types of information and how they are used by voters. Their results show that citizens in the Philippines use the information introduced about (and from) political candidates effectively, for instance by rewarding them for fulfilling their promises.

The audience reviews a brochure during Cesi Cruz and co-authors' presentation. Photo credit: Julia Luckett

One strategy to make clientelism costly is to increase citizen participation beyond the act of voting. Pierre Nguimkeu presented a paper measuring the effectiveness of policies when voters are intrinsically motivated in a democracy. They showed that platforms built through town hall meetings, with active participation from constituents and focused on programs (i.e., policies, rather than individual and personalistic characteristics) were more electorally effective in Benin.

Technology could be further leveraged to enable an improved informational environment for the state and its agents. Yusuf Neggers presented a project in India where he and co-authors evaluated the adoption of a mobile-phone app to make the tracking of welfare program payments and delays easier for administrators at different levels. Improving the ease of accessing and acting on such information alone increases the efficiency and effort from bureaucrats, resulting in more timely government transfers and payments.

A final paper by David Yang showed that the state could lead this process of policy innovation. The paper documents China’s strategy of trying out new policies at the local level (“experimentation”) prior to a national scale-up.

Nathan Canen (University of Houston), Leonard Wantchekon, and Rohini Pande. Photo credit: Julia Luckett