Unlocking the power of data to improve social protection for India's poor

In collaboration with Indian policymakers, a research team based at Inclusion Economics created a mobile application to provide officials with data at their fingertips - and showed this simple step improved access and delivery of one of the world’s largest safety net programs.

Inclusion Economics Research Brief, September 2022

Often cited as the world’s largest social protection program, India’s Mahatma Gandhi National Rural Employment Guarantee Act benefits tens of millions of rural households in India – yet challenges in program administration of the program can decrease the program’s usefulness for the poor, and may reduce take-up by needy households. A research team based at Inclusion Economics collaborated with Indian policymakers to create PayDash – a mobile app that uses existing administrative data to flag problems and initiate follow-up. Now a rigorous evaluation has shown PayDash to improve program performance, and the team is expanding the project to new areas and working on version 2.0.

The Challenge: Using administrative data to improve social safety nets

Government officials in charge of social protection programs often must juggle work across a variety of time-sensitive tasks, many of which involve coordination with other officials. Managing priorities and meeting deadlines is more than simply a management challenge: when tasks are delayed, poor households reliant on social protection programs may fail to receive benefits on time and struggle to meet their daily needs. Consequently, management tools that help government officials address their tasks more efficiently can lead to tangible improvements in service delivery for the poor.

In India, the Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA) is the central social protection scheme for the rural poor; it provides up to 100 days of paid manual labor to tens of millions of poor households in rural areas. While program payment infrastructure has greatly benefited from investments in digital financial systems, wage payment delays persist, and there is still a complex and hierarchical process to approve wage payments. Conversely, in bandwidth-constrained settings, transitioning to digital payments infrastructure can actually increase payment delays.1 These delays can discourage participation by vulnerable daily wage workers; impose costs on program participants as they struggle to follow up on delayed payments; and attenuate program impacts on food security, rural livelihoods, and gender equality.

The Solution: A web and mobile monitoring platform for government workers

Since 2013, researchers from Inclusion Economics at Yale University and Inclusion Economics India Centre – in collaboration with colleagues from IDinsight and the University of Michigan – have worked with India’s Ministry of Rural Development to increase the user-friendliness of MGNREGA data and make the program more efficient. Based on these policymaker discussions, the team has developed and tested a novel mobile and web application, called PayDash, to help government officials acquire information relevant to monitoring and managing the MGNREGA payment process.

Yusuf Neggers on using technology to close information gaps and improve governance

The EGC Visiting Scholar discusses his interdisciplinary research examining questions at the intersection of development economics and political economy, with a focus on state capacity, elections, and the delivery of public services.

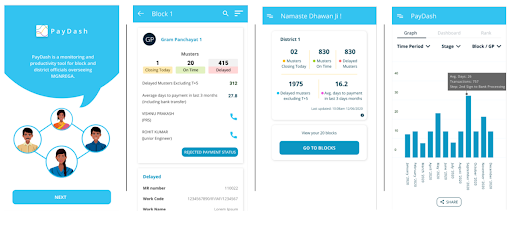

PayDash uses timestamped data on when each sub-step of the payment process occurs in order to help officials more quickly process pending wage payments. Importantly, this process is automated and not prone to tampering. It is built on application programming interfaces (APIs) that feed real-time information on details of delayed payments from the MGNREGA management information system (MIS), with linked information and contact details on employees responsible for each administrative step at the levels of gram panchayat (GP, the village-governing unit of Indian government – across Madhya Pradesh and Jharkhand, there are approximately 3 villages in each gram panchayat) and block (a group of GPs), to MGNREGA administrators. PayDash is designed to be multilingual, intuitive, and easy to navigate, and offline functionality ensures officers can use the app when in areas with limited internet and mobile connectivity. PayDash also includes a performance dashboard where officials can view their jurisdiction's current and historical processing time performance, both overall and by payment approval step.

PayDash decreases administrators’ cost (in staff time and effort) of acquiring information useful to identifying and monitoring poorly performing sub-regions and employees. It clearly identifies where and at what steps delays are originating and who could help address the delay.

Phase I: Rigorous evidence of PayDash impact

The research team evaluated the effects of the PayDash application in a randomized evaluation across two states in India, Madhya Pradesh and Jharkhand, between 2017-2020. They completed an additional randomized evaluation in a third state, Bihar, in March 2021. In these statewide studies, we trained officials on the PayDash application and then monitored their usage and MGNREGA program outcomes. In Madhya Pradesh and Jharkhand, this intervention spanned 75 districts and 573 blocks, involving approximately 1,300 district and block officials and 7.7 million workers (Financial Year 2016-17 numbers).

In some areas, the research team provided access only to district-level MGNREGA administrators; in other areas we provided access only to block-level MGNREGA administrators. In remaining areas, PayDash was provided either to both district- and block-level MGNREGA administrators, or to no officers. This research design allowed the team to understand differences in outcomes between areas that had access to PayDash and those that did not, as well as untangle the impact that PayDash had when provided to one or both levels of the payment process hierarchy.

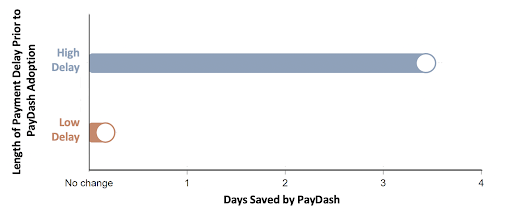

Early results show that the app reduced payment processing times by 1.2 days (11%), on top of other gains made by the states during this period. Gains are concentrated in high delay areas where officers report being particularly busy and stretched – suggesting app information helps them prioritize precious time. In high-delay areas, payment processing times declined by 3.4 days (17.8%) as compared to only 0.1 days (1.5%) in low-delay areas. The researchers observed improvements in other dimensions as well: 5.7% decrease in variation to time to payment, 13.3% increase in person-days worked, 21% decline in middle-manager transfers, and no major increase in corruption.

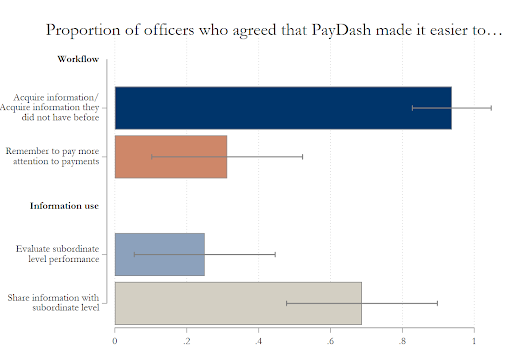

The study design also allowed us to observe the importance of collaboration across the hierarchy. The team sees no gains to providing both district and block officials access to PayDash, and officers report PayDash helping them acquire and share relevant information with others who work with them (see Figure 3). This runs against the idea that the app was solely useful for monitoring – instead, hard-working bureaucrats collaborated to better meet program objectives.